blogs

blogs

The magnet moment nobody can ignore

With geopolitical tensions around rare-earth materials filling industry news, leading OEMs and Tier 1s are scrambling to find ways to blunt surging prices, supply chain uncertainty, and chart a course toward magnet-free or magnet-lean designs.

When China froze rare-earth export licenses in April of this year, as retaliation for US tariffs, rare earth spot prices tripled[1] and shipments were stranded for weeks[2], shutting down western vehicle manufacturers and supplier plants at short notice. Now that materials are flowing again, there's a pressing need to secure limited licenses and build magnet stockpiles for future shocks.

If €100 worth of magnet can pause production of a €50,000 car, you have a board-level problem.

Three converging risks

All automakers, industrial motor manufacturers as well as wind turbine companies face three key risks that have found new urgency:

- Geopolitical chokepoint: China owns ~92% of NdFeB magnet production[3], with a handful of officials deciding export licenses. OEMs and Tier 1s outside of this territory will potentially remain hostage to this supply monopoly, unless they can find alternatives.

- Price whiplash: violent spot moves and future contract uncertainty are expected for at least another 18 months. The recent deal between MP Materials and the US DoD raised the floor for neodymium- and praseodymium-based magnets to $110/kg[4]; double the current spot price from China and baking in higher costs that everyone will pay.

- Logistics volatility: on-again, off-again shipments create shipping bottlenecks reminiscent of the 2021-22 semiconductor shortage for automakers, created by the COVID-19 pandemic. June 2025 exports remain 38% below 2024 shipments, despite strong demand[5].

Failure to tackle these risks and rare-earth dependency will remain a significant vulnerability to any OEM.

The road ahead divides

Addressing these risks requires you to take one of two roads, or both, depending on how much market time you have:

Road 1: The magnet-free leap: move from internal permanent magnet (IPM) motors to Electrically Excited Synchronous Motors (EESM) or Induction Motors (IM). You’ll need a clean sheet: new rotor, stator, inverter, control software, and different cooling loops are all required. You're in for 3-5 years of development, as well as significant capex investment.

You’ll eliminate rare earth magnets entirely but will potentially lose between 2-6% efficiency from your motor and have to deal with brushes, slip-rings, or extra copper that service engineering teams must address.

Road 2: The ‘magnet-lean’ sprint: stay with your current IPM architecture and use AI/ML to find motor designs that deliver the same performance but with less magnet material leading to 5-15% on e-motor BOM costs.

While you'll re-stamp rotor laminations and adjust inverter control maps, your line fixtures, stator assembly tooling, and gearbox interfaces may require only minimal changes. This means you keep leveraging millions in existing industrialization investments while reaching start-of-production (SOP) in just 18 months. Whilst this approach done well can result in no loss of motor efficiency, you can reduce your rare-earth magnet reliance by up to a quarter, reducing geopolitical challenges and providing a valuable buffer against future price volatility within your current product cycle.

E-motor OEMs and Tier 1s we're working with are escalating Road 2 urgency as low-cost insurance while magnet-free projects mature.

Magnet-lean in practice

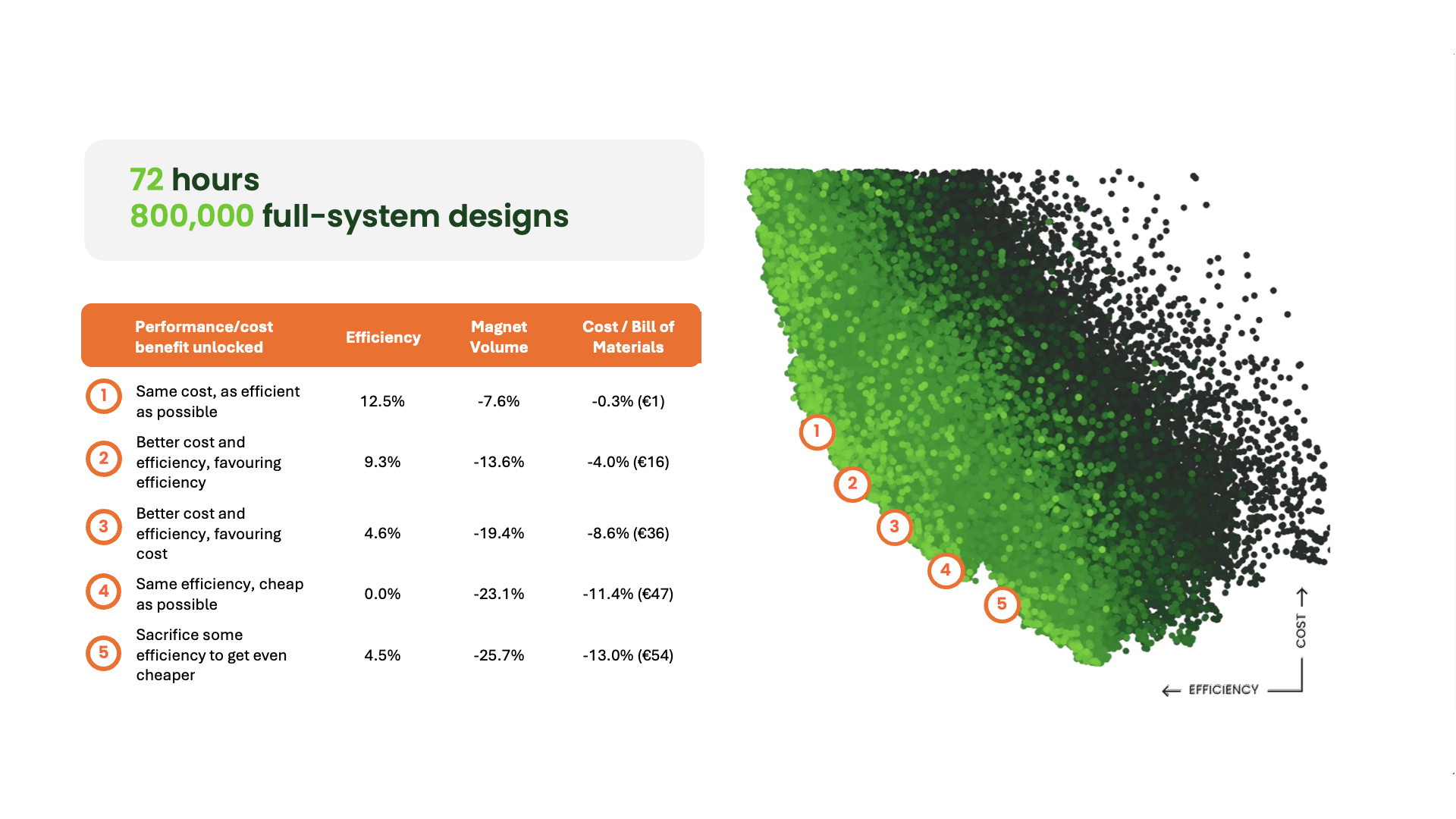

Monumo developed its Anser® engine to find hidden cost savings while maintaining performance. Leveraging AI/ML and novel e-motor modeling, Anser generates hundreds of thousands of cost-saving motor design variants in days, by optimising magnet sizes, material grades, flux barrier positions, and inverter PWM waveforms.

In a much-noticed recent project, Anser delivered 23% magnet volume reduction with no loss of efficiency in a previously optimised, 220 kW IPM EV motor with L-42EH magnets – that’s a 11.4% motor BOM cost saving (€47 per unit), resulting in €235M savings over a 5-million motor production lifetime.

Figure 1: Unlocking magnet and cost reductions with Anser

With Monumo’s Anser tech and partnership approach, you don’t need an internal AI/ML stack. We take your current motor requirements, quickly explore a wide optimisation space, and present a Pareto curve of motor design options, so you can choose the cost–efficiency sweet spot. We then deliver an exclusive, magnet-efficient design in your favorite file format for both prototyping and production, typically within weeks, cutting rare-earth magnet content by 20%+ with no material trade-offs in motor performance, if that is your preference. However, Anser works across multiple parameters, and as Figure 1 shows, there are trade-offs to be considered between cost reduction and efficiency, to name but two.

Cut content and risk

A wholesale leap to magnet-free drives may eventually erase the sourcing risk for rare-earth magnets, but it won't defuse the next tariff shock or price spike. A ‘magnet-lean’ redesign you can launch in 18 months greatly reduces risk exposure today, improves margins and achieves your cost targets early, buying you valuable time until your EESM or induction motor development can be brought to market.

References

[1] Nikkei Asia: “Rare-earth prices triple to new records on China export curbs”

[2] CLEPA: “Urgent action needed as China's export restrictions on rare earths disrupt European automotive supply chains”

[3] US Department of Energy: “Rare Earth Permanent Magnets: Supply Chain Deep Dive Assessment”

[4] Reuters: “MP Materials seals mega rare-earths deal with US to break China's grip”

[5] Reuters: “China's exports of rare earth magnets to the US surge in June"